Negative effects of a premier DTI

Generally, mortgage lenders or any other creditors favor an optimum DTI regarding 43%. Although not, lenders like to come across a personal debt-to-money ratio lower than one to show that the newest costs wouldn’t affect your capability to settle your home mortgage.

In general, a high DTI insinuates that you struggle to pay the money you owe on time, along with your budget is smaller flexible for lots more loans.

At exactly the same time, you will possibly not be eligible for some funds, including personal and you can home loans. Even if you get accepted for a financial loan, your higher debt-to-income proportion can be yield your quicker positive words and better attract costs because the you might be recognized as a riskier borrower to loan providers.

Mortgage Degree

The most significant impression out-of a high DTI is not are in a position to be eligible for financing. As the we’ve mentioned, a top DTI informs loan providers that you might already getting offered also narrow to adopt so much more obligations. Because mortgage loans are usually more pricey than many other variety of loans, lenders can be reject the application if your DTI proportion is higher than 43%.

Naturally, additional factors, just like your possessions and you can discounts, could play a task within the loan degree, very having a top DTI will not instantly leave you ineligible. But it causes it to be much harder to secure a home financing.

Rates of interest

Even though you can also be secure a mortgage with a high DTI proportion, lenders need to mitigate the risk of that gives investment. Because your large DTI ratio suggests that you will be overextending oneself currently, their bank you will shield themselves against their incapacity to repay the mortgage giving you highest interest levels.

Large rates suggest expenses furthermore the life span of the loan. In the event you may be acknowledged for a loan, it’s important to know if we wish to spend so much more due to high interest rates that can impression your money of numerous many years to come.

Install the brand new Griffin Silver application today!

Extremely lenders and you may mortgages need a DTI out-of 43% or lower. Sooner or later, you really need to go with no more than 43% of your gross month-to-month earnings going into expense, including a separate home mortgage. Therefore, for individuals who sign up for that loan which have an excellent DTI already from the 43%, you’re less inclined to rating acceptance getting a conventional loan having rigorous financing standards.

Luckily, you will find some loan programs readily available for consumers with less than perfect credit. However, again, the brand new tough their borrowing from the bank and higher the DTI ratio, the higher the rates will be.

The DTI is just too High. So what now?

When you yourself have a premier DTI, there are several steps you can take to do this and you will initiate reducing it before applying for a financial loan. Several a means to replace your probability of providing recognized to have home financing are the after the:

Come across Forgiving Funds

Particular money have more versatile lending conditions where you can qualify for a home loan with high DTI proportion. Including, FHA financing having basic-date homebuyers make it DTIs as high as fifty% in many cases, despite shorter-than-primary credit.

Va funds could be the really flexible with regards to financing requirements because they make it being qualified veterans, energetic obligation service people, and you will enduring spouses to place off as little as zero % with the payday loans Loma financing.

All of the financing program and financial have various other qualifying requirements, so it is imperative to see the options to discover the best loan software predicated on your financial situation.

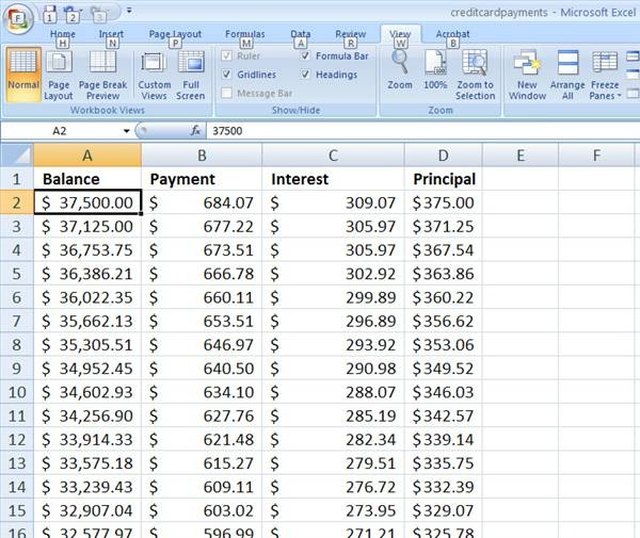

Refinance Your debt

You might be in a position to lower your DTI proportion because of the refinancing otherwise restructuring your existing financial obligation. For example, you’re able to re-finance figuratively speaking, playing cards, unsecured loans, and you may present mortgages for a diminished interest rate or prolonged cost conditions.