- Make sure your costs was reported. Before applying having an excellent subprime financing, ask in case your bank records your account towards the about three consumer credit agencies: Experian, TransUnion and you will Equifax. Which ensures their on-go loans Valmont CO out payments will appear on your credit history, which can only help to alter your credit.

- Usually help make your mortgage fee on time. To end lost an installment, put reminders, put the loan deadline in your diary or build an automatic percentage from the family savings. (Make an effort to are able to afford in the account so you’re able to defense new payment.) The newest timeliness of the repayments is the solitary greatest cause for your own FICO Rating.

- Should you choose skip a payment despite your time and effort, usually do not panic. As an alternative, shell out it as in the near future too. Late money are not reported to credit bureaus up until he or she is 29 those times due. Even if you end up being recharged a later part of the fee and you will face other penalties, a fees that’s not too long delinquent shouldn’t affect their credit history.

The way to get a good Subprime Financing

Lenders enjoys other definitions from subprime consumers, thus examining your credit rating would not give you a definitive address towards where you are, but it will provide you with smart. If for example the credit history falls at higher end of subprime diversity, you can get finest mortgage terms and conditions because of the delaying the loan application a bit as you work to improve your credit history. (Much more about one afterwards.)

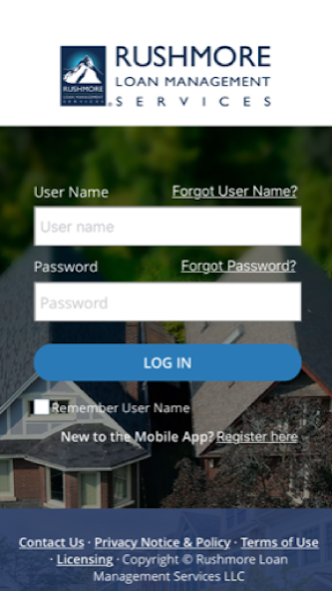

Look Lenders

You can get subprime loans, borrowing unions or online lenders. Your bank is an excellent starting point but verify examine money out of a number of provide. Such, you will find firms that specialize in subprime financing. Think credit unions, which don’t charge more 18% for the subprime money-lower than various other lenders. Quite often, you’ll have to join the borrowing union, and this usually means opening a merchant account, one which just get financing. You prefer good subprime consumer loan otherwise car loan? It can save you a little while by using Experian CreditMatch, a no cost equipment that shows the loan providers that will be fitted to you based on your credit score.

Shop around

The way to try to get approved to possess a good subprime financing is to use for a couple of them. For every single loan application trigger an arduous query on the credit history, that can temporarily decrease your credit history. Yet not, for those who complete any software in this a few weeks, credit scoring models commonly lose all of them overall query, so that you will not be penalized for evaluation shopping. FICO tend to amount the loan applications registered in the same forty-five-date months overall inquiry; VantageScore gives you 14 days.

Be prepared

According to the financial, you might have to offer records such as for example a current shell out stub to show your income, email address from the company to ensure their a career, otherwise family savings statements to ensure your property.

If you find yourself having problems providing approved having a good subprime mortgage, see if the lender allows somebody who has a good credit score so you’re able to cosign on loan with you. Just like the cosigner was responsible for paying down the mortgage if the that you do not, and financing look on the credit rating, make certain they are prepared to do the exposure.

On the look for a loan, look out for cash advance and you may car term fund. Such as loans can charge rates out of 400% or higher, together with higher charge, and certainly will make you better in financial trouble than in the past otherwise trigger that get rid of important assets.