Otherwise qualify for a conventional loan or if you has actually less credit score, this new FHA Loan also provides an alternative route to home ownership.

While you are prepared to apply for an enthusiastic FHA Loan, DSLD Financial can make the procedure worry-totally free. Verify that you be eligible for an enthusiastic FHA Financing by the requesting good callback from 1 your Mortgage Officials.

FHA Financing Advantages

Brand new FHA Mortgage includes a lower credit history demands and you may lower down payment requirements, rendering it style of mortgage a famous choice for very first-time home buyers and those having a smaller-than-finest credit history.

Consult a no cost Mortgage Appointment

Apply at one of our Mortgage Officials to talk about their homebuying desires. We’re going to generally speaking pre-qualify you for an enthusiastic FHA in 24 hours or less.

Romantic in your New house

I make sure to pay attention and see exactly what your you would like to be able to progress confidently.

What’s an enthusiastic FHA Financing?

A keen FHA Mortgage, and this represents Government Property Management Mortgage, are yet another types of financial. Its particularly covered from the FHA, making sure a safety net to possess lenders and you may and then make homeownership far more obtainable to the people just who will most likely not qualify for a traditional Loan.

Available for lowest to help you average-money individuals and you can very first-date home buyers , the brand new FHA Financing is obtainable actually to people with lower credit scores. This method lets of a lot to apply for an enthusiastic FHA Loan on the web and also a go from the homeownership, regardless of if their financial history isn’t perfect.

While you are seeking get a keen FHA Financing, it’s necessary to understand what kits it other than a traditional Financing. FHA Funds, supported by new Government Property Management, tend to come with straight down interest rates minimizing credit rating criteria, plus don’t want PMI, leading them to a stylish choice for many aspiring people.

But that’s not absolutely all. The fresh FHA Application for the loan procedure is made with you at heart. Having less down repayments and a lot more lenient being qualified standards than just old-fashioned loans, it’s an approachable roadway for the majority of that have a straightforward FHA Financing software techniques, specifically those entering their very first household or seeking to another begin in the homeownership travels.

That is qualified to receive an enthusiastic FHA Mortgage?

When you’re FHA Financing are open to everyone, they might be specifically popular certainly one of basic-day homebuyers and the ones which have smaller-than-prime credit. FHA Money are specifically designed to generate homeownership open to a great larger directory of some one payday loan Gerrard. The down interest levels and you will shorter down repayments render a favorable substitute for people who might find the standard financing procedure and you can criteria a little while intimidating.

Once you get an enthusiastic FHA Loan, you aren’t just getting a home loan; you’ll receive chances. The new lenient qualifying criteria of FHA Application for the loan means that even though you provides flaws in your credit history, you have a path forward having DSLD Mortgage.

Do you know the FHA Mortgage standards?

FHA Money are known for the a whole lot more versatile criteria compared to the old-fashioned loans. So you can meet the requirements which have DSLD, you want the absolute minimum credit history away from 620. The debt-to-income ratio (DTI) is fundamentally become below 43%, while some conditions will get implement. While doing so, the home you intend to pick need certainly to see FHA assessment requirements.

How to submit an application for an enthusiastic FHA Mortgage?

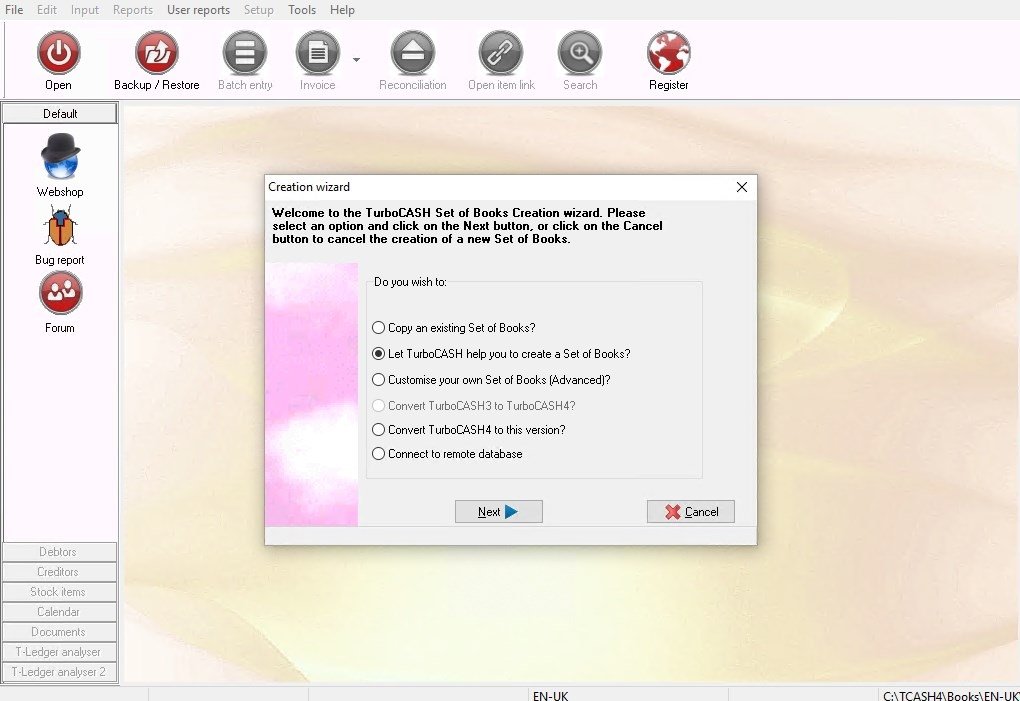

The FHA Loan application processes begins with looking a keen FHA-acknowledged lender, such as for instance DSLD Financial. You’ll be able to start out with a good pre-qualification to obtain an estimate out of just how much you may also qualify to possess. 2nd, you can submit a full app with supporting records. Your lender will likely then have the possessions appraised and you will publish your own declare underwriting review. Before very long, it is possible to proceed to closing!

Exactly what records should i get an FHA Loan?

To streamline your own FHA Loan application, gather files like current shell out stubs, W2s, tax statements, financial statements, evidence of quarters, their Societal Safety credit, and you will a legitimate ID. Your financial will offer an entire range of certain requirements built in your individual circumstances.

How much time really does brand new FHA Loan application process normally simply take?

The fresh new FHA Loan application techniques takes from a couple weeks to a few days. Brand new timeline hinges on how fast you likewise have all the necessary documents, the newest underwriter’s workload, and other circumstances. Coping with a talented lender may help improve process just like the effortless and you will successful as possible.

What are the closing costs for the an enthusiastic FHA Mortgage?

FHA Funds incorporate closing costs like most almost every other financial. Anticipate paying charges on the appraisal, mortgage origination, identity qualities, plus. Some of these settlement costs might be rolled in the financing count otherwise potentially discussed to the vendor.

Can i re-finance my existing financial which have an enthusiastic FHA Financing?

Yes, you can refinance your existing mortgage that have a keen FHA Financing. This will be a powerful way to possibly lower your attract price, improve your loan term, or make use of their house’s equity with a finances-out re-finance.

Were there constraints in order to how much I will borrow that have an FHA Financing?

Sure, when you submit an application for a keen FHA Mortgage, there are specific restrictions so you can just how much you might obtain. The fresh state and you may state for which you want to pick property establishes these FHA Financing limitations. Awareness of these limits is essential as they can influence your own home-to acquire options.

To be certain you get one particular associated and you may accurate pointers tailored to your unique state, i encourage hooking up which have one of our loyal Financing Officers. If you decide so you can continue the fresh new FHA Loan application processes which have DSLD Financial, all of us will be here to guide you, making sure you might be really-informed and confident every step of ways.