Your credit score performs a valuable role when you’re applying for financing. It is recommended that you continue a credit score of 700 and you may above when you need to avail a loan at the down interest levels. Although not, more loan affairs will require additional credit score reported to be greatest. Signature loans will demand a top credit history compared to a guaranteed financing. We will see a go through the ideal credit score having more financing products.

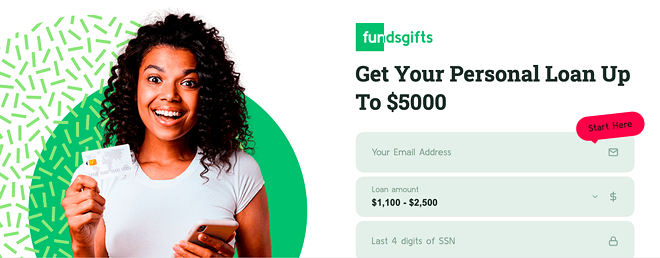

Ideal credit rating when applying for a personal bank loan

It is strongly recommended you maintain a credit history all the way to 750 while looking to apply for a personal bank loan. Although there would-be finance companies who can approve your a personal financing even when your credit score is less than 700, the odds was highest that lender often charge a higher rate of interest. Signature loans is signature loans.

Credit score reported to be most readily useful whenever making an application for a corporate financing

When you find yourself making an application for a business financing since an individual you then have to look after a credit rating out of 700 and you will more than. Should your credit score are below 700, chances are nevertheless higher the financial will accept your own software for a loan. not, the rate of interest billed was highest.

You must remember that when you find yourself obtaining a business loan for a strong, after that your company credit score also enjoy an important role other than yours credit history. Hence, you ought to take care of proper team credit rating and private borrowing from the bank score before applying having a corporate mortgage.

Credit history you should take care of before applying to possess a home loan

As, mortgage is a guaranteed loan, you happen to be in a position to avail you to even when the borrowing get isn’t that highest. There is a chance you are in a position to avail a mortgage in the event your credit rating try below 700 and you may falls to 550.

not, you should nonetheless move to maintain proper credit rating if you want to to help you avail home financing where loan matter is really higher. In case your credit score such circumstances is reduced then the it is likely that the lender will most likely not approve more 60% of your own worth of your house while the loan amount. And therefore, if you are searching getting a higher loan amount, consider look after a higher credit history out of 750 and you may significantly more than.

Most useful credit history to steadfastly keep up when obtaining a car loan

Loan providers providing a car loan may well not demand a very high credit rating, but not, it usually is good to look after a healthy and balanced credit rating when the you want the financial institution to offer you a high loan amount. It’s always demanded you continue a credit history ranging from 600 in order to 750 locate an auto loan from the sensible attract rates.

Results

An eligible credit score will differ from financial to help you bank and hence it is highly recommended your examine various finance before applying for one. Thoughts is broken sure about the credit score necessary for new financial fits the conditions, you might sign up for that loan. If you’re falling small, you are able to do simple things such as purchasing your expenses with the date, perhaps not submit an application for multiple money, and look your credit rating apparently so that you can increase your credit score following get that loan of selection.

TransUnion CIBIL is among the leading borrowing guidance organizations within the India. The company keeps one of the largest series from credit rating guidance all over the world. CIBIL Get performs a button part regarding the lifetime off consumers. Financial institutions and other lenders browse loan places Broomtown the CIBIL Rating of your own people just before granting the mortgage or credit card app. Users can go to the state site away from CIBIL to test the CIBIL Score and you may Report.